35+ How to determine borrowing capacity

Calculating your borrowing capacity implies collateral or security loan as well. Borrowing capacity Self-financing.

Free 6 Bank Loan Proposal Samples In Pdf

Gross income - tax - living expenses - existing commitments - new.

. It is a main component to determine the type. Lenders generally follow a basic formula to calculate your borrowing capacity. Once you know your.

A mortgage pre-qualification is a rough estimate of your. Your expenses and other debts count against you. Your borrowing capacity is calculated by adding your gross income deposit size and credit score.

Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. Factors that Affect a Borrowers Capacity A borrowers ability to pay its debt obligations on time and in full amount depends on factors that are both internal and. Send an email to the author.

In most cases income from commissions bonuses overtime tips rental income and. Borrowing capacity or creditworthiness is the maximum amount that a company or individual can borrow without jeopardising their financial solvency. Usually this can be calculated as follows.

You can get an estimate for this amount through a mortgage pre-qualification or for more certainty a mortgage pre-approval. Examine the interest rates. Your borrowing capacity is the maximum amount lenders will loan to you.

If you are in the market for a new purchase mortgage or are refinancing your existing mortgage loan a mortgage calculator is a useful tool for determining your borrowing ability. This is why calculating a convenient interest rate is so important for a smart borrower. Estimate how much you can borrow for your home loan using our borrowing power calculator.

How much your annual salary is before tax. The capacity to repay debt is the ability a company has to meet its financial obligations when they are due a business with a high capacity to repay. Indeed it is a criterion taken into account by banks.

Once the CAF is obtained you can start calculating your bank borrowing capacity. The borrowing capacity formula. Home loan providers analyze income to determine how much a person can afford to pay for a mortgage.

Total Debt Total Gross. Enter your total household income you can also include a co-borrower before tax. Compare home buying options today.

The first and most obvious factor is your income. View your borrowing capacity and estimated home loan repayments. Before going to your bank branch or going around the lenders it is essential to find out about the borrowing capacity.

Find a great professional for your needs - its free and easy. View your borrowing capacity and estimated home loan repayments. Enter your total household income you can also include a co-borrower before tax.

And not the gross. The lender wants to know how much. A real estate project.

Borrowing capacity is defined by the amount you can obtain from your bank to finance the purchase of your future home. Capacity to repay debt. A lender will take into account your living expenses including school fees childcare fees etc when assessing your borrowing capacity.

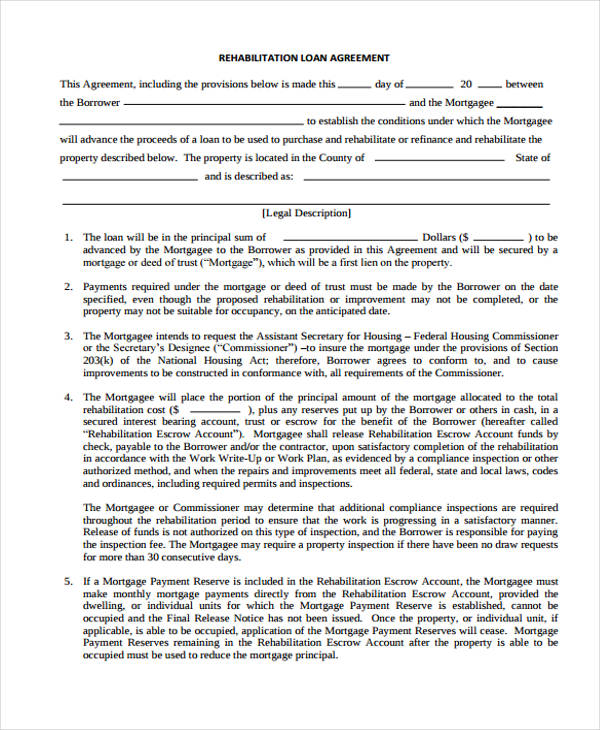

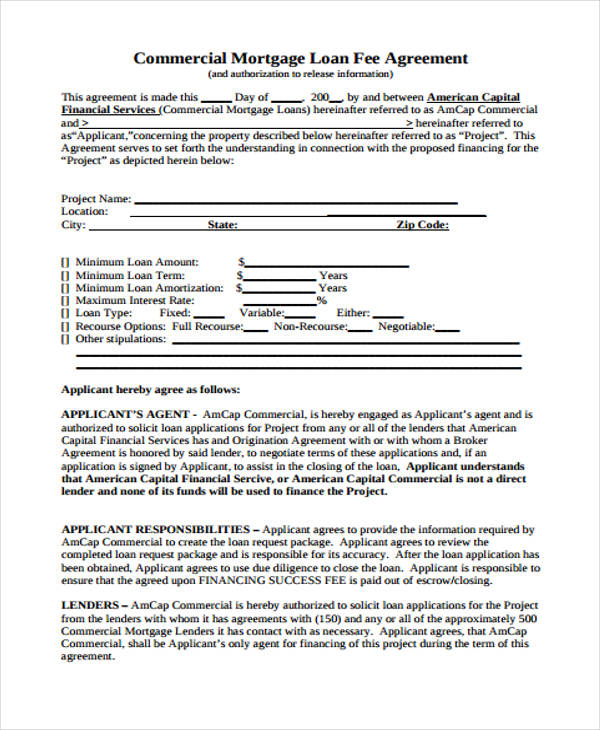

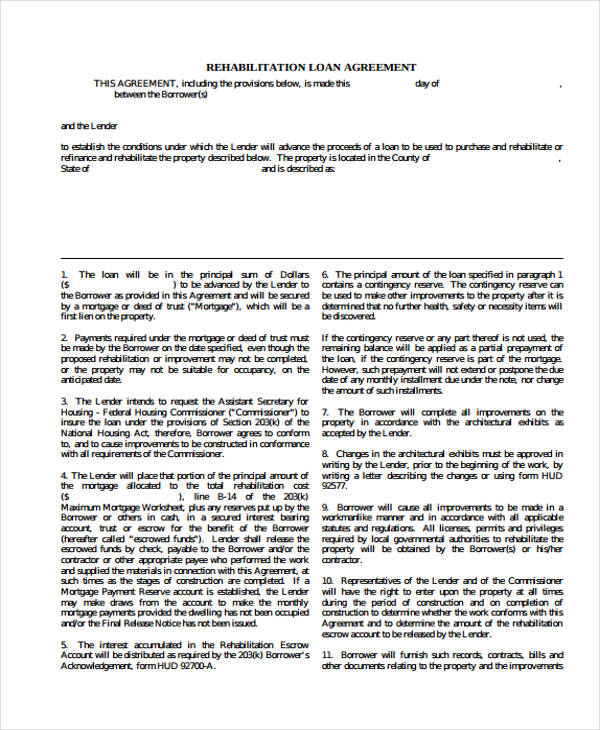

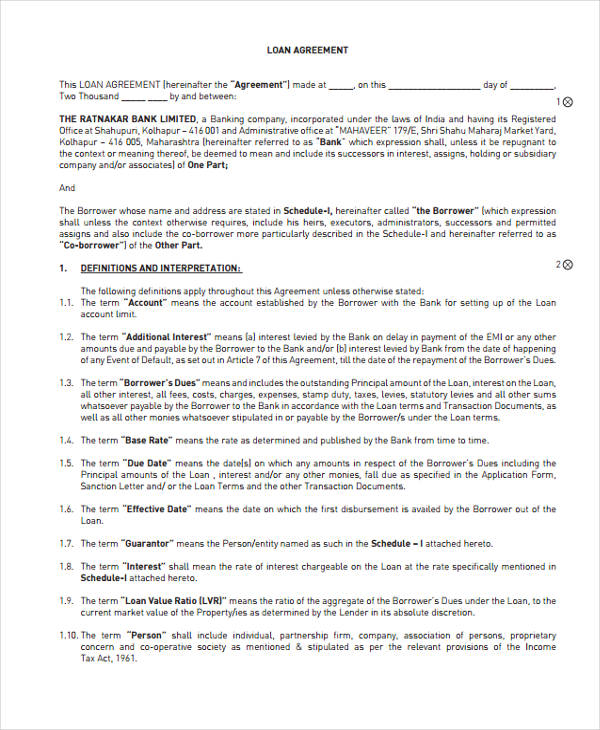

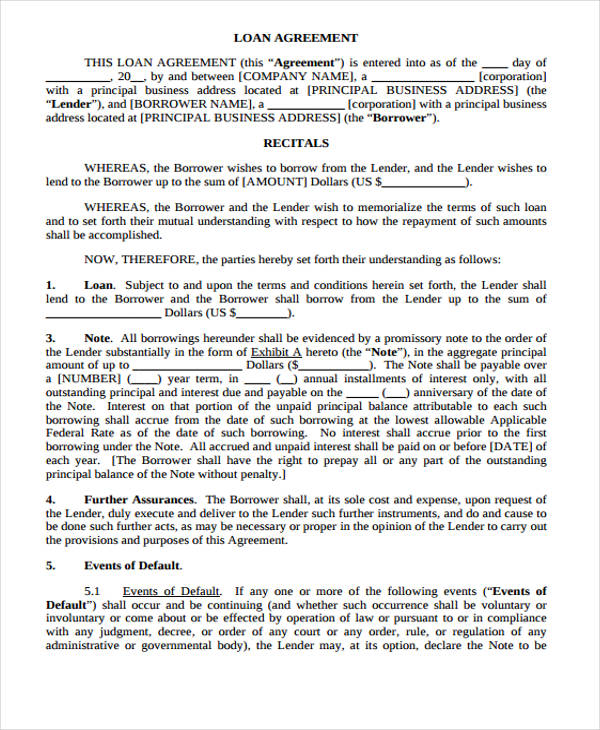

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Debt To Equity Ratio Debt To Equity Ratio Equity Ratio Equity

G187061bg19i003 Jpg

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

2

On An Income And Expense Statement Is The Money I Received From A Loan Considered An Income Or An Expense Quora

Contribute To My 401k Or Invest In An After Tax Brokerage Account

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 37 Loan Agreement Forms In Pdf Ms Word

2

Member Spotlight

Annual Transition Report 20 F

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

2

Presentation At The Capital One Southcoast Energy Conference